Línea Directa obtains a net profit of € 0.9 million in the third quarter

- The result is the fruit of the pricing, underwriting and claims management measures implemented by the company in 2023, which have enabled the Group to improve its margins in the third quarter of the year, recording a net profit of € 0.9 million for the period.

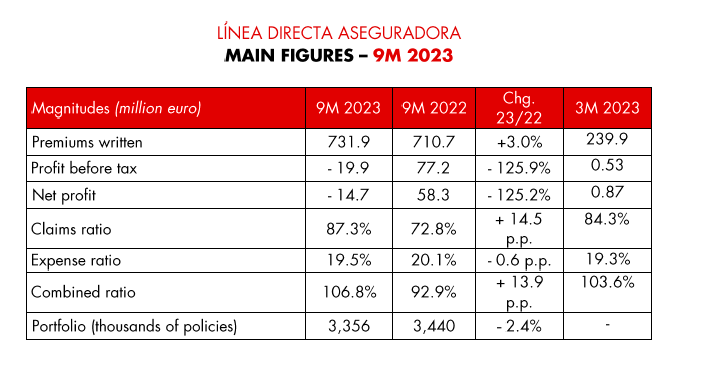

- However, the cumulative net result for the first nine months of the year adds up to a negative € 14.7 million, due to the strong impact of inflation on the cost of services.

- Income from premiums increased by 3% between January and September compared to the same period a year earlier, reaching € 731.9 million, as turnover grew in all areas of the business (Motor, Home and Health).

- Premiums earned for the year, which are reflected in the income statement along the 12-month duration of contracts, increased by 4.3%, reflecting the individualised adjustment of the rates to current risk assessments.

- Ongoing control of overhead expenses and efficiency gains derived from digitalisation pushed the expense ratio down to 19.5% (- 0.6 p.p.), one of the best in the sector.

- The Group's accumulated combined ratio for the year was 106.8% at 30 September. Thanks to the optimisation of claims management, the third quarter alone closed at 103.6%, an improvement of - 6.1 p.p. compared to the previous quarter. The improvement was even greater for the Motor business line (at - 8.8 p.p.).

- The solvency ratio stood at 180%, with a margin of € 153.2 million over required capital.

Madrid, 27 October 2023.- Línea Directa Aseguradora closed the first nine months of 2023 with results that continue to show the effect of the current inflationary pressures, but which are also beginning to reflect the positive effect on margins derived from the implementation of the action plan announced by the Chief Executive Officer, Patricia Ayuela, at the General Shareholders' Meeting.

The Group posted a negative net result of € 14.7 million between January and September, due to the impact of continued elevated levels of inflation in the cost of services on insurance margins. However, for the third quarter alone, the net result was positive, at € 0.9 million. The improvement stems from a number of factors: a significant reduction in the cost of claims, especially in the Motor business line; an increase in turnover; as well as rigorous pricing, underwriting and management efficiency measures.

Growth in all business lines, with a focus on profitability

Línea Directa Aseguradora's total premium income at 30 September amounted to € 731.9 million, 3% more than in the same period a year earlier, reflecting the growth in turnover in its three business lines (Motor, Home and Health).

The positive trend in revenues offset the decline in the number of policyholders (-2.4%) to 3.36 million customers, in line with the Group's strategy of prioritising profitability over volume, pursued through risk-adjusted pricing to reflect the current inflationary environment, and a tightening in underwriting. The effect of the latter two measures can already be seen in the progressive growth of the premiums earned for the current year, which are gradually expressed in the income statement along the 12-month life of contracts. More specifically, premiums earned up to September increased by 4.3%.

Línea Directa's revenues from its Motor business line have surpassed € 595 million (a 2.7% increase), while its customer portfolio stood at 2.51 million policyholders. Premiums earned for the year in this business line grew by 3.4%.

Premiums written by the Home business line, counting with 734,000 policyholders, increased by 4.4% to € 111.6 million, against a backdrop of a sluggish real estate market, reflecting the rise in official interest rates. Premiums earned in this business line rose by 9.9%.

The impact of weather and water claims in the third quarter left the accumulated ratio for the first nine months of the year at 97.7% (+ 4.3 p.p.).

The Group's Health business line (where it has started to operate directly under the Línea Directa brand since last 24 September) has recorded a 4.1% growth in the number policyholders, to 110,000, and a 4.4% increase in income from premiums, to € 24.3 million. In a context of a stagnant growth in policyholders due to the economic cycle, the company continues to rigorously underwrite risk.

Cost containment and gains in efficiency and productivity

The Group's expense ratio stood at 19.5% (- 0.6 p.p.) on 30 September, one of the best in the sector. Línea Directa continues to increase its efficiency, driven by an ongoing control of overhead expenses and continued progress in digitalisation.

Gross operating expenses declined by 4.8% YoY, and by 6.8% for the third quarter alone. Digital services continue to perform at record levels, with 87.1% of customers now operating through digital channels. As a result, digital interactions with policyholders now average 1.2 million contacts per month via the Group's website and apps, 68% more than interactions by telephone, helping to improve operational efficiency and productivity in terms of premium volume per employee, which increased by 6%.

Action plan and margin improvement in the third quarter

The claims ratio reached 87.3% (+ 14.5 p.p.) and the combined ratio 106.8% (+ 13.9 p.p.), mainly due to the persistent inflationary pressure on the costs of services in the Motor and Home business lines, but also to an increase in the injury ratio during the last few years.

As part of its action plan to offset the inflationary pressure felt on results, the company has been implementing measures to streamline claims management, the positive effect of which can already be seen in the technical margins.

As a result, the company's claims ratio decreased in the third quarter by - 7.1 p.p., compared to the previous quarter, thanks to a decline in the cost of claims of - 6.4%. This led to an improvement in the combined ratio in the third quarter of - 6.1 p.p. to 103.6%, driven in particular by a remarkable performance in the Motor business line (which improved by - 8.8 p.p. from the previous quarter to 102.9%).

The financial result of the company totalled € 25.1 million, a decrease of 3.7% compared to the same period a year earlier due to higher capital gains realised during the past year. In recurring terms, excluding capital gains, it increased by 19.1%, driven by higher fixed income reinvestment rates.

The company's solvency margin in the first nine months of the year was 180% (- 6 p.p. compared to the first half of the year), with an excess € 153.2 million over required capital. As a result, the Group maintains a strong balance sheet consisting entirely of tier 1 or top quality capital.

In the words of Patricia Ayuela, CEO of Línea Directa Aseguradora, "As we anticipated, the complex inflationary situation continues to affect profitability in the insurance sector as a whole, as well as the result obtained by Línea Directa. However, our company is beginning to see the positive effects of our strategy, which is based on individualised adjusting rates, tightening underwriting and increasing efficiency in claims management, leading to a substantial improvement of our margins in the third quarter, especially in the Motor business line. At the same time, we continue to increase our efficiency, grow revenues profitably and maintain a solid and comfortable solvency position."