Línea Directa posts a profit of 40.7 million euros at september and accelerates growth in premiums and customers

- Línea Directa Aseguradora closed the first nine months of the year with a net profit of 40.7 millon euros, thanks to the significant improvement made to the insurance margin and growth in revenue and customers.

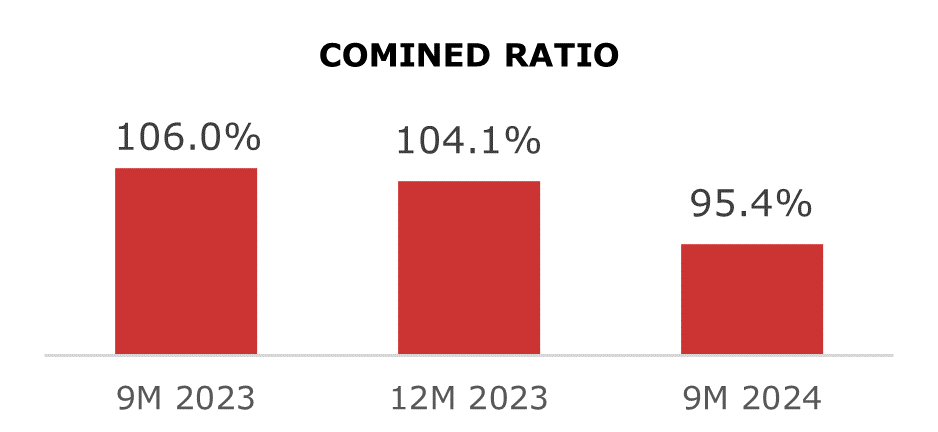

- The combined ratio stood at 95.4% at the end of September, 10.6 percentage points better than in the same period of the previous year, due to the reduction in claims costs and greater operational efficiency.

- Premiums written increased by 3.5%, reaching 757.6 million euros, with rising levels of turnover across all lines of business. In the third quarter alone, this growth accelerated to 5.7%, reflecting the boost in commercial activity.

- Increased sales and improved retention rates have led to a 58,750-policyholder increase (+1.8%) compared to the end of 2023, bringing the total to 3.38 million customers.

- The company maintains a very robust solvency ratio of 189.5%, entirely comprised of top-quality capital.

Línea Directa Aseguradora closed the first nine months of the year with sustained profit growth and a boost in all business figures. The company is thus accelerating the positive trend of results that began in the second half of 2023, in line with its strategy of profitability and growth.

The company posted a net profit of 40.7 million euros between January and September, compared with a net loss of 12.5 million euros in the same period of 2023, due to the impact of inflation.

The positive performance of the Group's earnings is primarily due to the improvement in the combined ratio, which stood at 95.4% at the end of the third quarter of 2024, 10.6 percentage points better than a year earlier.

This indicator shows a favorable trend in the three lines of business in which Línea Directa operates. In Auto, the company’s main business line by volume and the one most affected by cost inflation in recent years, the combined ratio improved by 11.1 p.p., standing at 95.5%, which compares favorably with the sector average of 101% as of June, the latest data available from ICEA. In Home, it improved to 89.8% (-7.0 p.p.), and in Health, it improved to 140.5% (-16.9 p.p.).

The excellent recovery in the insurance margin over the past year is supported by the reduction in claims costs and increased efficiency.

Specifically, the claims ratio improved by 10.2 percentage points, down to 73.4%, thanks to prudent risk underwriting, claims management measures, easing inflation, contained frequency, and fewer atmospheric perils. The expense ratio also shows a downward trend, decreasing to 22.0% (-0.4 p.p.), demonstrating the company's high level of efficiency, based on continuous cost control and increased digitalization of operations.

Acceleration in revenue and customers

The Group's positive results are also driven by the favorable progress in all business indicators, which show an acceleration in growth in both revenue and customers in the third quarter.

Total premiums written issued increased by 3.5%, reaching 757.6 million euros, with growth across all business lines (Motor, Home, Health, and New Products). Insurance revenue rose by 2.9%.

The strong commercial performance is particularly evident in the third quarter alone, where the growth in premium volume was 5.7%.

The increased activity also resulted in an expansion of the policyholder portfolio to 3.38 million customers, 0.5% more than at the end of September 2023, showing an upward trend. Compared to December 2023, the customers base grew by 1.8%, with nearly 60,000 additional policyholders.

This business boost has been supported by greater commercial effectiveness stemming from the company’s new multi-product strategy, a competitive commercial offering and product innovation, which in the past year has included the launch of new insurance products against home occupation, pet insurance and personal mobility insurance.

Evolution by business lines

By business lines, Motor premiums written grew by 2.9% to 612.5 million euros, while insurance revenue rose by 2.4%. In the third quarter alone, premiums advanced by 5.4%, and the portfolio reached 2.48 million policyholders.

Línea Directa’s Home segment also recorded solid growth between January and September in both premiums written (117.0 million euros, up 4.8%) and insurance revenue (110.6 million euros, up 4.6%). Similarly, in the third quarter alone, this line accelerated its growth, with a 5.7% increase in premiums, and the portfolio exceeded 731,500 policies.

Health, with 117,500 policyholders, continues to improve its figures quarter by quarter. Premiums written increased by 10%, reaching 26.8 million euros, while insurance revenue rose by 8.7%. In the third quarter alone, premiums grew by 12.9%.

Meanwhile, New Products (including insurance against home occupation, Pet Insurance and Personal Mobility Insurance) now contribute 44,000 policies to the Group and a premium volume exceeding 1.3 million euros (+77.0%).

The financial results for the first nine months of 2024 came to 26.9 million euros, up 11.7% on a recurring basis due to the higher return on fixed income. Including extraordinary items, the financial results increased by 6.1%.

Línea Directa maintains a very robust solvency margin, which rose to 189.5% in the third quarter, fully comprised of Tier 1 or top-quality capital.

According to Patricia Ayuela, CEO of Línea Directa Aseguradora, “the evolution of our results has been very solid quarter by quarter, showing a clear upward trend in all indicators, with a progressive acceleration in revenue and customers growth and a very robust solvency level. These figures reflect the commitment to the strategy we set in 2023. This, combined with the strength of our business model, will lead to greater growth and profitability.”

LÍNEA DIRECTA ASEGURADORA

MAIN FIGURES 9M 2024

| KPIs (million euro) | 9M 2024 | 9M 2023 | Chg. 24/23 | Q3 2024 |

| Premiums written | 757.6 | 731.9 | +3.5% | 253.7 |

| Insurance income | 736.8 | 716.2 | +2.9% | 250.2 |

| Technical profit/(loss) on insurance activity | 32.9 | -41.7 | n/a | 11.3 |

| Gains/(losses) on investments | 26.9 | 25.4 | +6.1% | 10.3 |

| Profit/(loss) before tax | 53.9 | -17.0 | n/a | 19.6 |

| Profit/(loss) after tax | 40.7 | -12.5 | n/a | 15.3 |

| Claims ratio | 73.4% | 83.6% | -10.2 p.p. | 73.5% |

| Expense ratio | 22.0% | 22.4% | -0.4 p.p. | 21.9% |

| Combined ratio | 95.4% | 106.0% | -10.6 p.p. | 95.4% |

| Portfolio (thousands of policies) | 3,377 | 3,360 | +0.5% | 3,377 |