Línea Directa posts a profit of 64.2 million euros in 2024 and accelerates growth in revenue and customers

- Línea Directa Aseguradora achieved a net profit of 64.2 million euros in 2024 thanks to a significant improvement in the insurance margin and solid growth in revenue and customers across all business lines.

- The company's Board of Directors will propose to the General Shareholders' Meeting a complementary dividend charged to the results of the 2024 financial year of 1.38 euro cents gross per share. In this way, the total remuneration to shareholders for the past financial year would amount to 4 cents per share, with a total amount of 45 million euros.

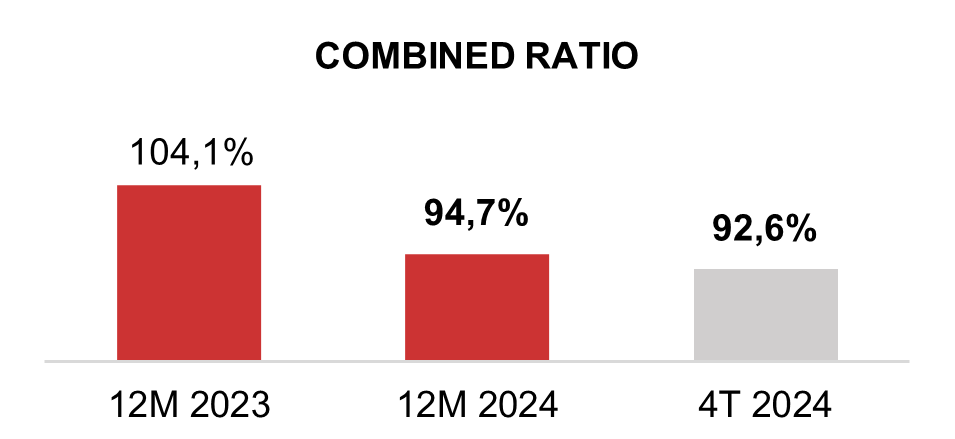

- The combined ratio stood at 94.7% at the end of the year, 9.4 percentage points better than in 2023 due to the reduction in claims costs and greater operational efficiency.

- Premiums increased by 4.8% to reach 1,019.6 million euros, surpassing 1,000 million for the first time in the company's history. In the fourth quarter alone, this growth accelerated to 8.6% due to the strong boost in commercial activity.

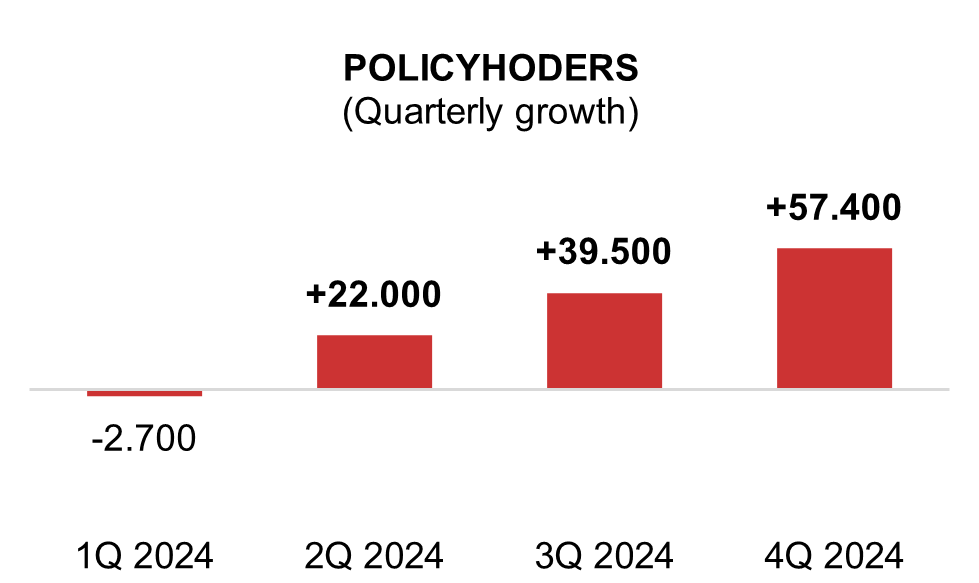

- The customer portfolio grew by 3.5% to 3.4 million policyholders, representing an increase of 116,200 customers for the year.

- The company achieved a RoAE of 19.6% and maintains a very solid solvency ratio of 185.4% (192.5% without the complementary dividend).

Patricia Ayuela, CEO Línea Directa y Carlos Rodríguez, CFO Línea Directa.

Madrid, 29 January 2025.- Línea Directa Aseguradora closed a very positive 2024, showing a solid and upward trend in profit generation supported by excellent technical performance and accelerated growth in revenue and customer numbers across all business lines.

The company achieved a net profit of 64.2 million euros in 2024, compared to a negative net result of 4.4 million euros in the previous year due to the impact of the inflation crisis, mainly in the automobile insurance sector.

The positive evolution of the Group's income statement is explained, on the one hand, by the outstanding improvement in the combined ratio, which at the end of the year stood at 94.7%, 9.4 percentage points better than in 2023. This indicator showed progressive improvement quarter by quarter and in the fourth quarter alone it dropped to 92.6%.

The combined ratio performed excellently in the three branches in which Línea Directa operates. In Autos, it improved by 9.7 p.p., standing at 94.8%, which compares very favorably with the sector average, which at the end of September, the latest available data from ICEA, was 100.3%. In Home, it improved to 88.3% (-7.5 p.p.) and in Health to 140.3% (-17.9 p.p.).

This increase in the company's insurance margin is supported by the reduction in claims costs and the greater efficiency achieved by the entity. Specifically, Línea Directa's claims ratio improved in 2024 by 8.6 p.p., to 72.6%, thanks to rigorous underwriting, claims management measures, moderation of inflation, and contained frequency. Meanwhile, the expense ratio also maintained an improving trend and fell to 22.1% (-0.8 p.p.), resulting from continuous cost control and increasing digitalization of operations.

The company's good commercial performance is based on the entity's new multiproduct strategy, greater commercial effectiveness, the launch of new products, a very competitive offer, and the increase in digital sales.

Strong boost in digital sales

Línea Directa advanced in 2024 in the digitalization of its operations and user experience in its digital channels (website and mobile application) with the implementation of generative Artificial Intelligence (AI) and the optimization of the app.

This resulted in greater adoption of digital channels, so that already 90% of the company's policyholders interact through them, and customers' digital interactions exceed 2 million accesses per month. Additionally, in 2024, the number of policies sold through digital channels was 2.4 times higher than the previous year.

Business evolution

By branches, Motor grew in premiums by 4.2%, to 826.2 million euros, while insurance revenue increased by 2.7%. In the fourth quarter alone, premiums increased by 8.2%. The portfolio reached 2.51 million policyholders (+1.8%), with a net gain of 43,300 customers in the year.

The Home business line also shows solid growth. The volume of premiums issued increased by 5.6%, to 157.8 million euros, and in the fourth quarter, growth accelerated to 8.0%. Insurance revenue advanced by 5.0%, and the customer portfolio grew by 1.7%, to 739,000 insured homes.

Health, with 121,000 policyholders (+3.5%), performed excellently in 2024. Premiums issued grew by 11.4% (and 17.2% in the fourth quarter alone), to 33.9 million euros, and insurance revenue by 9.1%.

Meanwhile, New Products (Insurance against home occupation and Personal Mobility Insurance, among others) already contribute 60,000 policies to the Group and a premium volume of 1.7 million euros.

Línea Directa's financial result in 2024 was 39.6 million euros, 16.6% more thanks to higher fixed income revenue, which grew by 32.3%.

Shareholder remuneration: 45 million in dividends

The Board of Directors of Línea Directa Aseguradora, once the audited Annual Accounts are formulated, will propose to the General Shareholders' Meeting the distribution in cash of 0.0138 euros gross per share as a complementary dividend charged to the results of 2024 for a total amount of approximately 15 million euros.

With this new payment, which would be added to the two interim dividends already paid throughout the year, Línea Directa's total remuneration to shareholders in 2024 would amount to 0.0414 euros per share. In this way, the total amount allocated to shareholder remuneration would rise to 45 million euros from the entity's profits in 2024.

Línea Directa has increased the return on equity (RoAE) to 19.6%. Additionally, the company maintains a very robust solvency margin, and at the end of the year, it stood at 185.4%, including the payment of the complementary dividend (192.5% without that dividend).

In the words of Patricia Ayuela, CEO of Línea Directa Aseguradora, "we closed 2024 with very positive results. We are generating profits in a recurring and solid manner and accelerating our growth in revenue and policyholders more and more. These results are the result of the decisive execution of our action plan and the fulfillment of the strategic priorities we had set for the year, and they prepare us for a new stage of greater growth and profitability. In this 2025, when Línea Directa turns 30, we will continue working to consolidate the company's growth, diversification, and transformation. On these pillars, we are building the future of Línea Directa."

LÍNEA DIRECTA ASEGURADORA

MAIN FIGURES 12M 2024

| KPIs (million euro) | 2024 | 2023 | Chg. 24/23 | Q4 2024 |

| Premiums written | 1.019,6 | 973,3 | +4,8% | 261,9 |

| Insurance income | 991,3 | 960,3 | +3,2% | 254,6 |

| Technical profit/(loss) on insurance activity | 51,2 | -38,2 | n/a | 18,4 |

| Gains/(losses) on investments | 33,9 | 25,4 | +16,6% | 12,7 |

| Profit/(loss) before tax | 83,3 | -6,5 | n/a | 29,4 |

| Profit/(loss) after tax | 64,2 | -4,4 | n/a | 23,5 |

| Claims ratio | 72,6% | 81,2% | -8,6 p.p. | 70,2% |

| Expense ratio | 22,1% | 22,9% | -0,8 p.p. | 22,4% |

| Combined ratio | 94,7% | 104,1% | -9,4 p.p. | 92,6% |

| Portfolio (thousands of policies) | 3,435 | 3,319 | +3,5% | 3,435 |