Línea Directa accelerates growth in premiums to 4,4% in 2022 and reaches record income of 946 million euros

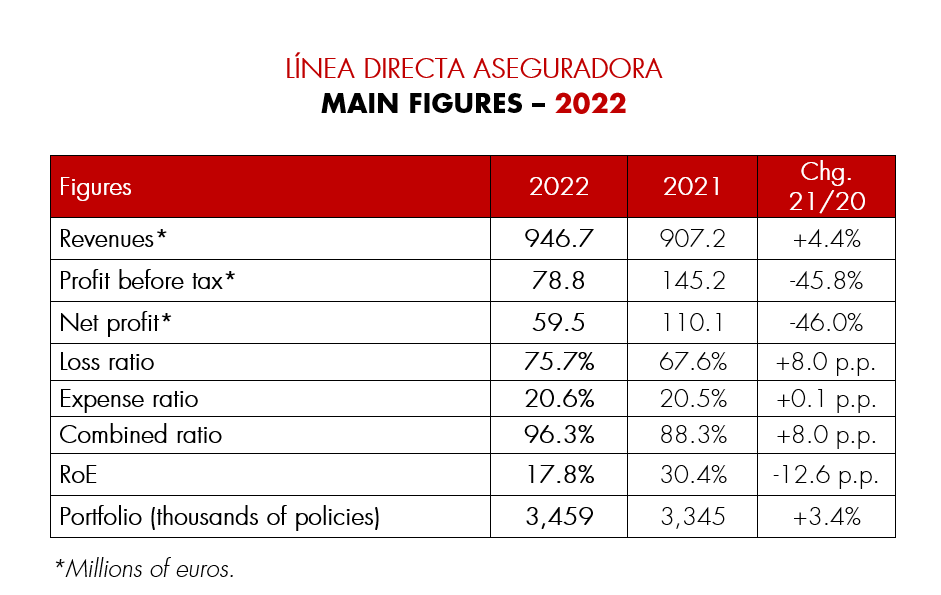

- Línea Directa Aseguradora's premium income increased by 4.4% in 2022 and exceeded 946 million euros, which is record turnover for the company and a recovery in growth rates seen prior to the Covid-19 pandemic.

- The number of Group customers increased by 3.4%, and closed the year with 3.46 million policyholders, thanks to the new business and good loyalty.

- The turnover in Auto insurance increased by 3.3% in the year, accelerating its growth: In the last quarter of the year it rose by 4.6%. Revenues in Home (+9.5%) and Health (+10%) continue to perform well, beating the market and increasingly contributing to the diversification of the Group's business.

- In an adverse situation marked by record inflation that is putting pressure on the margins of the insurance sector as a whole and by the higher loss frequency in Auto and Home, the Group's combined ratio stood at 96.3%. In this context, Línea Directa obtained a net profit of 59.5 million euros.

- The expense ratio remained stable at 20.6%, one of the best in the market, thanks to the tight control of overhead expenses.

- Línea Directa Aseguradora closed 2022 with a solid balance sheet and a comfortable solvency margin of more than 188.

- For the first time, customers that only interact with us through digital channels surpassed those that do so over the phone thanks to a 40% increase in the number of active Línea Directa apps.

Madrid, 24 February 2022.- Línea Directa Aseguradora's net profit in 2022 was 59.5, million euros in an extraordinarily adverse market environment, marked mainly by record-high inflation and an increase in claims that has affected the insurance industry as a whole. During the year, the company has once again shown considerable control of overhead expenses, which remained stable, and a positive commercial performance that has translated into an acceleration of revenue growth.

The Group's premium turnover for the year as a whole stood at 946.7 million euros, the highest volume in the company's history and more than 4.4% compared to the same period of 2021. In 2022, Línea Directa therefore practically quintupled the growth of the previous two years and has restored turnover growth rates seen prior to the Covid-19 pandemic.

This change is the result of the growth in turnover in all the business lines in which it operates (Auto, Home and Health) thanks to the introduction of new customers and good levels of loyalty. The portfolio increased by 3.4%, in total 114,000 policyholders, and reached 3.46 million customers, supported by the positioning of Línea Directa with a multi-branch offer, a new customer vision and the company's focus on the quality of the service provided.

Growing momentum in the Auto business

By branches, the commercial behaviour of the Car branch stands out. Revenues amounted to 772.8 million euros, up 3.3%, in line with the industry average, and recorded a gradual acceleration. The company's turnover in this segment grew in the fourth quarter by 4.6%, above the 1.7% recorded in the first three months of 2022 and the advance of 3.4% and 3.5% in the second and third quarters. This places the Group among the first two large companies in the growing industry.

This dynamism in the main line of business is noteworthy considering the weakness of the automotive market, with sales still 35% below the levels of 2019 and below the barrier of one million cars sold per year, which is causing a rapid ageing of the car fleet, and strong competition in the insurance market.

In this context, the company increased its portfolio of Motor policyholders by 2.7%, to almost 2.6 million customers. The positive trend of its new products focused on new mobility also stands out, such as Póliza Respira , for electric vehicles and plug-in hybrids and that has allowed the company to reach a portfolio of 18,500 cars and motorcycles with these engines, and Llámalo X, the insurance policy with car included, which in 2022 reached 2,000 units sold since it was launched.

Commitment to diversification

In Home, Línea Directa continues to outperform the market in volume growth. The company's turnover in the sector increased by 9.5%, 4 p.p. more than the sector as a whole, to 143.7 million euros, driven by a portfolio growth of 5.6%, to 752,000 policyholders. This line of business already accounts for 15% of turnover, contributing to the diversification of the Group's revenues.

Vivaz, the health insurance brand of Línea Directa Aseguradora, also maintains strong growth in revenues and customers despite the slowdown in the increase in policyholders that the sector is experiencing as a result of the current economic cycle. The company grew by 4.6% in terms of customers, exceeding 110,000, and 10% in premium revenues, up 2.6 p.p. versus the sector, standing above 29 million euros.

The Group's insurance result was impacted in 2022 by a very adverse economic and market situation that has affected the insurance sector as a whole nationally and globally, especially entities specialising in car insurance. High inflation, which has caused a sharp and sudden increase in repair costs, the increase in the scale of injuries and fatal accidents, the increase in the accident frequency in Cars and Home due to mobility having recovered to pre-pandemic levels, together with average premium levels being at historic lows, has had an extraordinary impact on the technical margins of the sector. In this context, Línea Directa Aseguradora's net profit in 2022 stood at 59.5 million euros (-46%).

This inflationary pressure and the greater frequency on the income statement meant that the Group's loss ratio reached 75.7% (+8.0 p.p.) and the combined ratio reached 96.3% (+8,0 p.p.), since the growth of premium income, which has a longer calculation cycle in the results, still does not offset the strong increase in average costs.

In the words of Patricia Ayuela, CEO of Línea Directa Aseguradora, “2022 has been a year of an unprecedented economic and market environment, with record cost inflation, higher claims and weakness in vehicle sales that has caused a sharp deterioration in margins in the insurance sector as a whole. Despite this current adverse situation that is penalising us in terms of short-term profit, Línea Directa has demonstrated positive results in terms of business generation, efficiency and balance sheet strength. We have a solid business model and a well-defined strategy that will help us to achieve all our priorities and that are already delivering visible results."

Differential expense ratio and balance sheet strength

Despite this, Línea Directa Aseguradora maintained one of the best expense ratios in the market, of 20.6% (+0.1 p.p.), thanks to the efficiency of its direct business model and its strict and continuous control of overhead expenses, which shows that the Group is making progress in its objective of maintaining this differential and continuing to lead the sector in terms of efficiency. The Group's financial results showed a favourable performance, with an improvement of 14.7% to 39.8 million euros.

The company has once again maintained one of the highest levels of profitability among its peers, with an RoE of 17.8%, and a robust and stable balance sheet, with a solvency margin of 188.4%, consisting entirely of tier 1 or top quality capital and aligned with the company's dividend policy.

Growing digitisation

Línea Directa continues to make progress on strategic priorities such as digital transformation, focused on strengthening the relationship with customers and improving efficiency. In 2022, it exceeded one million active apps (+40%), which gave an additional boost to the digitisation of the portfolio. For the first time in the history of the company, the number of customers who carry out their transactions through digital channels every month now exceeds the number of customers who do so over the phone.

Contributing to sustainable growth

Last year, the Línea Directa Group took another step forward in its commitment to sustainability and the integration of the best environmental, social and governance practices, as well as the Sustainable Development Goals (SDGs), into its strategy. Among other milestones, the company, which completed its 2020-2022 Sustainability Plan with a degree of compliance of 92%, reduced its carbon footprint in the year by 51% and its waste by 41%, and avoided the emission of 31,400 tons of CO2 through the portfolio of sustainable vehicles that it insures, contributing to the transition of its customers towards a carbon-neutral economy.

In addition, the company has approved a Sustainable Investment Policy, aimed at reducing exposure to controversial sectors, and has signed up to international initiatives such as the TCFD recommendations on climate risks promoted by G-20 and the Women's Empowerment Principles (WEP), an initiative promoted by UN Women and the United Nations Global Compact.